The smart Trick of Pacific Prime That Nobody is Discussing

Insurance coverage additionally assists cover costs connected with liability (legal obligation) for damage or injury created to a third event. Insurance is a contract (plan) in which an insurance company indemnifies an additional versus losses from particular contingencies or perils.

Investopedia/ Daniel Fishel Many insurance coverage plan types are readily available, and basically any kind of specific or company can locate an insurance policy business willing to insure themfor a price. Most individuals in the United States have at the very least one of these types of insurance policy, and vehicle insurance policy is called for by state legislation.

Excitement About Pacific Prime

So discovering the rate that is right for you requires some research. The plan limit is the maximum amount an insurance company will certainly spend for a protected loss under a plan. Maximums might be established per period (e.g., yearly or plan term), per loss or injury, or over the life of the plan, likewise referred to as the life time optimum.

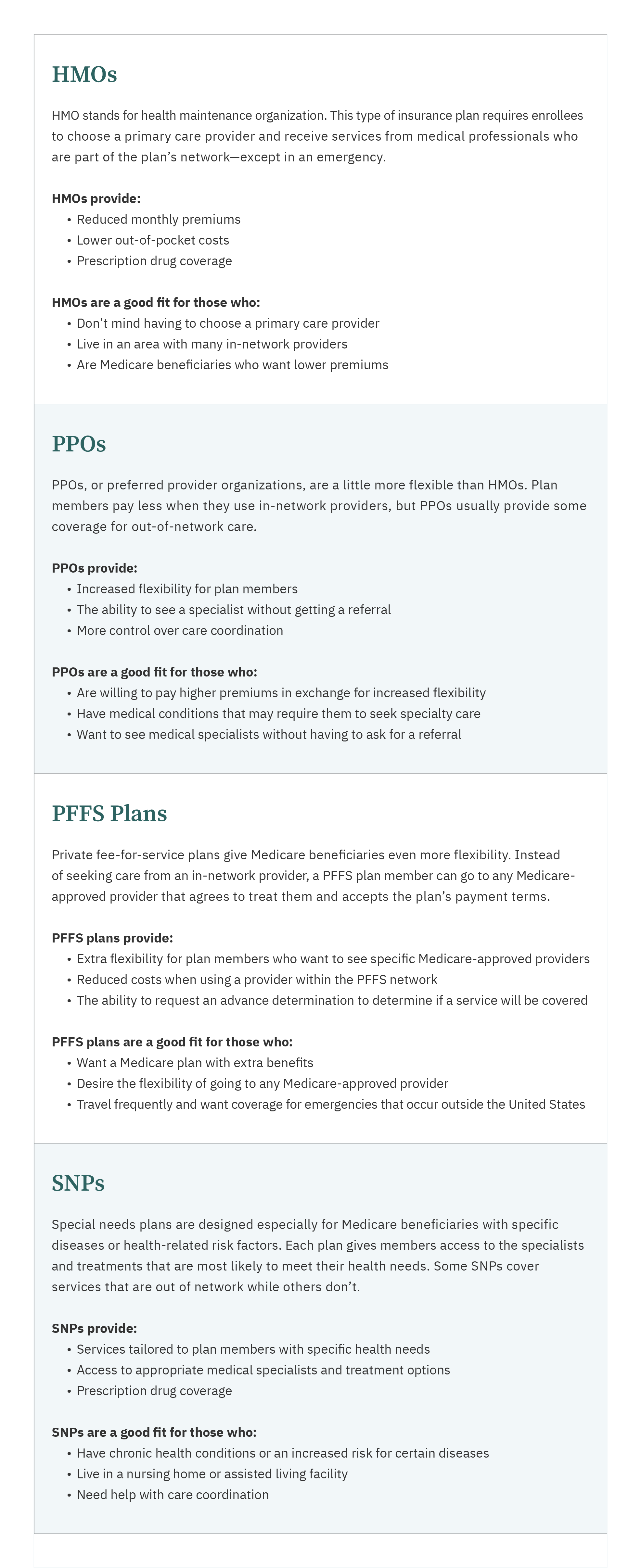

There are numerous different kinds of insurance policy. Health and wellness insurance coverage helps covers routine and emergency situation clinical care expenses, often with the choice to add vision and oral services individually.

Lots of preventive solutions might be covered for totally free prior to these are fulfilled. Wellness insurance might be purchased from an insurance company, an insurance policy representative, the federal Wellness Insurance policy Market, given by a company, or government Medicare and Medicaid coverage.

The 5-Minute Rule for Pacific Prime

Rather than paying of pocket for car crashes and damage, individuals pay yearly premiums to a vehicle insurance provider. The business after that pays all or most of the covered costs related to an automobile mishap or other vehicle damage. If you have actually a rented lorry or obtained cash to acquire a vehicle, your lending institution or leasing dealer will likely need you to carry auto insurance coverage.

A life insurance policy guarantees that the insurance company pays a sum of money to your recipients (such as a spouse or children) if you die. There are 2 main types of life insurance policy.

Insurance is a way to manage your economic dangers. When you acquire insurance coverage, you acquire security versus unforeseen financial losses.

Excitement About Pacific Prime

Although there are many insurance policy types, several of the most typical are life, health, home owners, and vehicle. The right kind of insurance policy for you will depend on your objectives and economic circumstance.

Have you ever before had a moment while looking at your insurance policy or shopping for insurance coverage when you've assumed, "What is insurance coverage? Insurance policy can be a mystical and perplexing thing. How does insurance coverage work?

Experiencing a loss without insurance can put you in a tough monetary situation. Insurance coverage is a crucial financial tool.

The Basic Principles Of Pacific Prime

And in some situations, like automobile insurance policy and workers' payment, you might be called for by regulation to have insurance in order to protect others - international health insurance. Learn more about ourInsurance options Insurance policy is basically a gigantic rainy day fund shared by lots of people (called insurance policy holders) and handled by an insurance coverage provider. The insurance provider makes use of cash accumulated (called costs) from its policyholders and other investments to pay for its procedures and to fulfill its promise to insurance holders when they sue

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)